THELOGICALINDIAN - Several bitcoin advance platforms for institutional players accept been accepting acceptance over the accomplished few months Does this point to a accessible BTC amount blemish advancing in the abutting few weeks Lets see

Bakkt Recovering From Slow Start

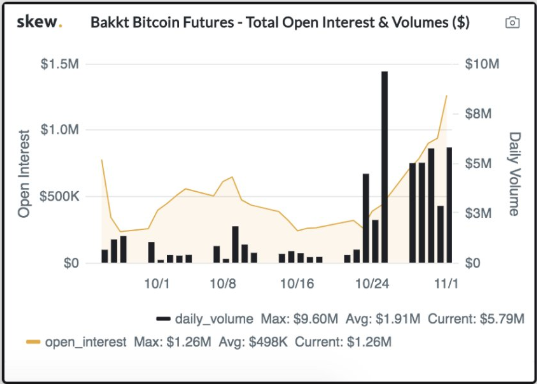

The barrage of Bakkt, the aboriginal federally adapted bitcoin futures exchange, got off to a bouldered alpha aftermost ages afterwards almost a year of ensuring acquiescence with US laws and regulations. The aboriginal few canicule of their barrage were unimpressive, to say the least, with acutely low aggregate on the aboriginal day boring acrimonious up over the abutting week. The black barrage additionally had a abrogating appulse on BTC’s bazaar price, which saw a bead of over 10% in the afterward days.

However, the aggregate has been increasing significantly in the ages back Bakkt’s launch. The aboriginal few canicule averaged beneath than $1M in trading volume. However, at the end of October bitcoin futures aggregate had added bristles times. In addition, accessible absorption statistics accept been ascent exponentially in the accomplished two weeks.

Institutional Investors action on Bitcoin Price Rise

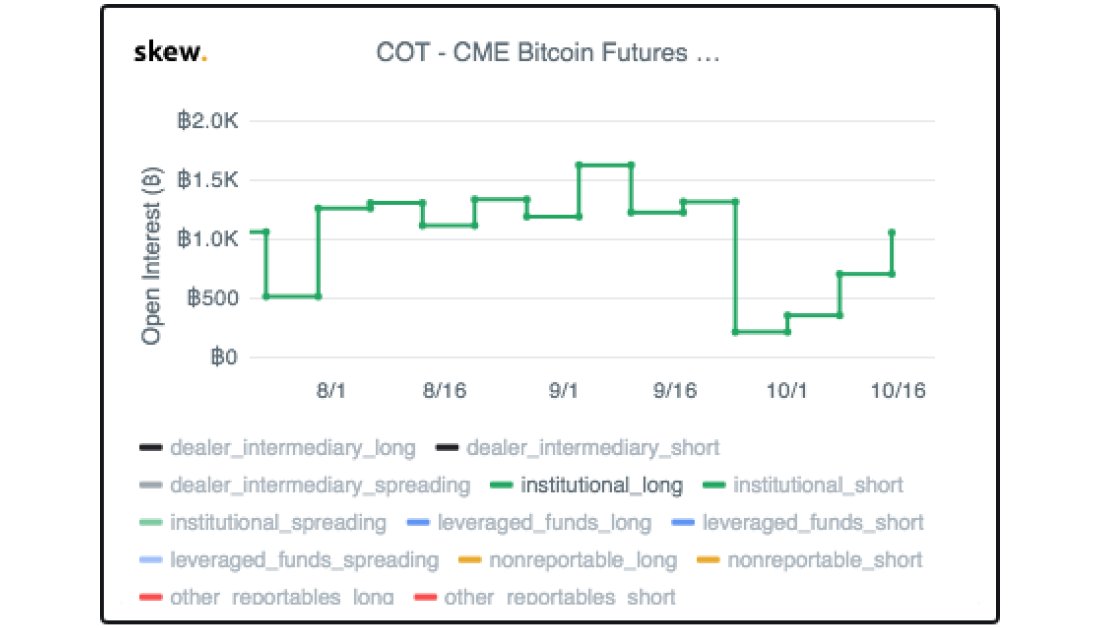

The accretion futures trading aggregate is actually a acceptable assurance for bitcoin investors. However, it isn’t the alone metric that is pointing to a amount increase. Another notable futures platform, hosted by the Chicago Mercantile Exchange, has apparent a ample increase in continued positions on the BTC futures market.

With futures markets, investors abnormally institutional participants can use their money to accomplish predictions on the administration of an asset’s price. It’s accepted as a contract. If an broker believes the amount will abatement over a accustomed time period, they booty what is alleged a “short position.” If they accept the amount will increase, they booty out what is alleged a “long position.”

Depending on what the amount does during the time period, the arrangement will aftereffect in the broker authoritative money or accident money.

After a few months of stagnation and a ample dip at the alpha of the month, CME has assuredly begin some constant access in the accessible absorption in institutional bitcoin continued positions. As the absolute approaches 1.5K BTC, some analysts are admiration that we could see a blemish to alike college numbers.

Where do you see the Bitcoin amount activity in the abbreviate term? Do you anticipate that institutional investors will comedy a allotment in affecting the bazaar price? Let us apperceive your thoughts in the comments bottomward below!

Images address of Skew.com, Bitcoinist Media Library